The Roundhill Sports Betting & iGaming ETF (NYSE: BETZ), which invests in a basket of gaming companies, outperformed the S&P 500 Index last week after underperforming the broad-based index for six consecutive weeks.

Notably, fears over a bubble in artificial intelligence (AI) stocks triggered a sell-off in tech names, which are the largest constituents of the S&P 500 Index. Amid the tech sell-off, investors sought shelter in other sectors that are relatively immune to the feared AI bubble.

The Star Entertainment Group and Codere Online were among the biggest gainers last week, experiencing double-digit gains. Robinhood and Corsair, however, made it to the list of biggest losers.

Biggest Gainers

Star Entertainment (ASX: SGR): +22.09%

With gains of over 22%, Star Entertainment was the biggest gainer in our coverage of gaming stocks. The gains almost entirely came on Friday after the company announced that it had secured the necessary regulatory approvals from the New South Wales Independent Casino Commission and Queensland’s Office of Liquor and Gaming Regulation, which allows the conversion of an Australian dollar 300 million investment from Bally’s Corporation and Investment Holdings Pty Ltd into equity.

The approval is nothing short of a lifeline for the cash-starved company, and its chairman, Anne Ward, termed it a “critical step in The Star’s progress towards a return to suitability and financial stability.”

Star has been taking steps to mend its unsustainable debt position, and in August, it reached a binding agreement to sell its 50% stake in the Queen’s Wharf Brisbane casino to Hong Kong-based partners Chow Tai Fook Enterprises and Far East Consortium.

Meanwhile, despite last week’s gains, SGR is down over 44% for the year as markets are apprehensive about the company’s highly leveraged balance sheet.

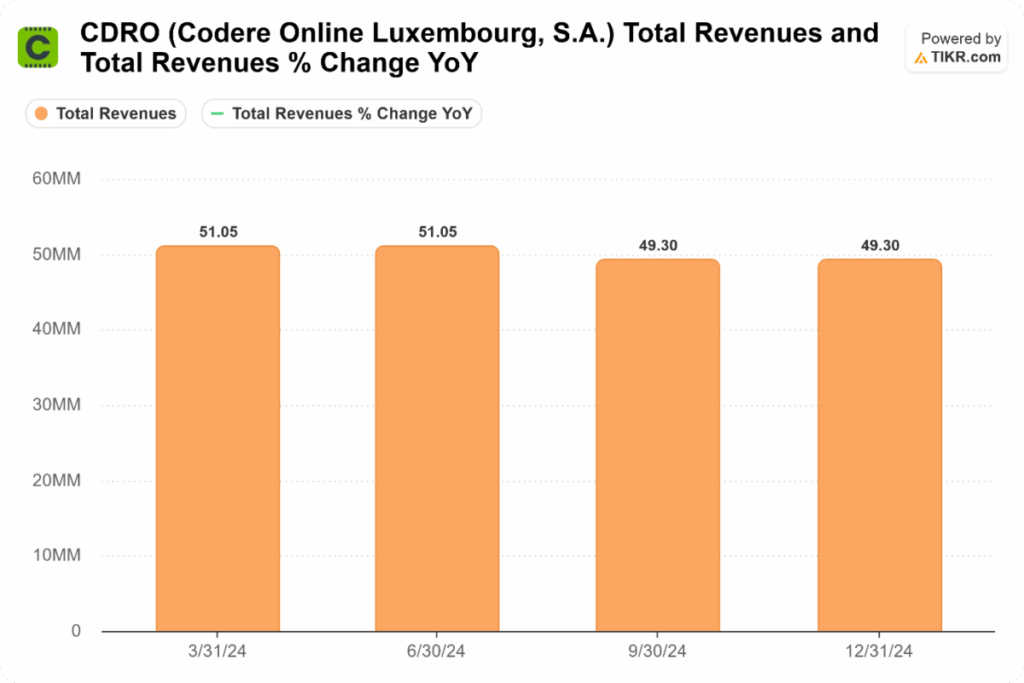

Codere Online (NYSE: CDRO): +18.28%

Codere Online gained over 18% last week as markets gave a thumbs-up to its Q3 earnings. While its net gaming revenues were flat in the quarter, adjusted EBITDA nearly doubled to €2.9 million in Q3 2025 compared to €1.5 million in the prior year. CDRO maintained its annual revenue and EBITDA guidance and noted an “encouraging recent trend” and a re-acceleration of net gaming revenues in the final quarter of the year.

The company has been working on efficiencies and cost cuts, and its marketing expenses reduced to €18 million in the quarter, which was their lowest quarterly outlay since the company’s listing in 2021.

Moreover, Codere’s board increased the share buyback plan from $5 million to $7.5 million, which further boosted sentiments and aided the upward price action.

Caesars Entertainment (NYSE: CZR) +7.79%

Caesars Entertainment was among the other major gainers last week, led by positive announcements. The company announced that it had extended its Founding Partner agreement with the Formula 1 Heineken Las Vegas Grand Prix through 2030. Separately, it announced the grand opening of an all-new, 16,000-square-foot trackside Caesars Sportsbook at Monmouth Park.

Notably, there was also a likely technical rebound in CZR following the drawdown in October following its Q3 earnings release. Multiple brokerages lowered CZR’s target price following that report, with Jefferies going a step further to downgrade the stock from a buy to hold.

However, some analysts believe that despite the recent struggles and debt concerns, the company remains undervalued based on its assets, land ownership on the Strip, and the long-term potential of its digital business. The stock carries a mean target price of $35.39, which is over 65% higher than current price levels.

Biggest Losers

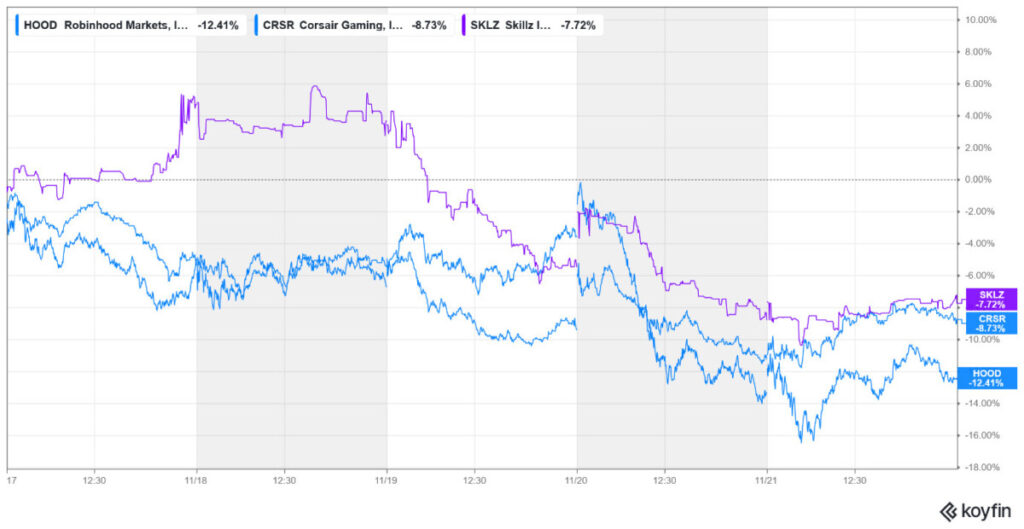

Robinhood (NYSE: HOOD) -12.4%

Robinhood, which has nearly tripled this year and is the second-best performing S&P 500 Index stock on a year-to-date basis, fell over 12% last week and was the biggest loser in our coverage of gaming stocks.

There was no company-specific news last week, and Robinhood has looked weak amid the tech sell-off.

Investor worries about the broader economy, such as surprisingly strong job growth potentially leading the Federal Reserve to hold off on interest rate cuts, have soured the mood for growth stocks like Robinhood.

The cryptocurrency crash has also put pressure on Robinhood, as crypto trading has been a key growth pillar for the company. Meanwhile, the next big bet for Robinhood is prediction markets, which was unsurprisingly one of the key highlights of Robinhood’s Q3 call held earlier this month.

CEO Vlad Tenev stated that prediction markets represent Robinhood’s fastest-growing business ever, reaching the milestone of generating $100 million or more in annualized revenue in under a year. Robinhood’s prediction volumes are growing at an astronomical pace and have doubled every quarter since the launch last year.

Tenev shared an ambitious, long-term vision for prediction markets, believing they could become “one of the largest asset classes” because they enable pricing risk in “pretty much anything.” He expressed excitement about being an early player in this “new asset class.”

However, for now, the tech and crypto crash seems to be the biggest driver for Robinhood stock, even as the company bets on prediction markets for long-term growth.

Corsair Gaming (NYSE: CRSR) -8.73%

Corsair Gaming stock fell nearly 9% last week, which extended its year-to-date losses to 16%. The stock has looked weak this month after missing Q3 2025 earnings estimates. Corsair reported net revenue of $345.8 million, which, while up 14% year-over-year, was below the analyst consensus estimate of $353 million.

The company reported adjusted earnings per share (EPS) of $0.06, which fell short of the consensus analyst forecast of $0.09. To make things worse, the company lowered its 2025 revenue guidance to between $1.425 billion and $1.475 billion.

Meanwhile, Corsair Gaming announced a leadership transition last week, appointing Gordon Mattingly as CFO, effective December 2, 2025. He will succeed Michael G. Potter, who will remain an employee until the end of the year in an advisory capacity to the CEO and thereafter as a consultant through March 31, 2026, to ensure a smooth transition.

Skillz (NYSE: SKLZ) -7.72%

Skillz yet again made it to the list of biggest gaming losers, and after last week’s fall, its year-to-date gains have narrowed to just about 4%. The company reported its preliminary Q3 earnings earlier this month, which were a mixed bag at best. Its revenues were $27.4 million, which were broadly in line with estimates. However, despite an improvement in its adjusted EBITDA loss compared to the prior year, the company still reported a significant net loss of $17.4 million, which dampened sentiments.

In its Q3 preliminary filing, SKLZ said that it is still working to file its annual Report for 2024 and its quarterly reports for Q1 and Q2 2025. The company stated that, although it has received a notice from the NYSE regarding noncompliance, it does not anticipate any immediate impact on its listing. However, continued noncompliance with exchange rules could potentially lead to delisting and is among the reasons investors are apprehensive of the former meme stock.

Other Major Gaming Industry Developments

Macau’s gaming sector experienced a slight decline in average daily revenue at the beginning of November, attributed to post-holiday seasonality. However, analysts noted the fall was milder than expected, and non-gaming visitor spending is beginning to stabilize, indicating continued slow recovery and strategic consolidation among operators.

Elsewhere, Sky Bet, a major UK gambling operator, relocated its headquarters to Malta to leverage its favorable tax regime, potentially cutting its UK tax payments by £55 annually. Notably, there is an air of uncertainty among gambling companies in the UK over the expected tax hike on the sector by Chancellor Rachel Reeves in her upcoming budget.

Meanwhile, prediction markets continue to attract new players. Last week, Fanatics CEO Michael Rubin confirmed that the company will launch prediction markets in the coming weeks, expressing disbelief that sports betting and gaming loopholes have not been closed by regulators.

More Information & Source

Original Source:

Visit Original Website

Read Full News:

Click Here to Read More

Have questions or feedback?

Contact Us