Tom Waterhouse of Waterhouse VC warns well-meaning regulations are unintentionally accelerating the shift to offshore operators.

In mature betting markets, regulation serves three fundamental purposes: protecting consumers, maintaining market integrity, and generating sustainable tax revenue. In principle, these aims are aligned. In practice, they can come into conflict.

Nowhere is this tension more evident than in the UK, but similar dynamics are playing out globally. Reforms aimed at reducing gambling harm have introduced growing friction, and more consumers are shifting their activity to unlicensed alternatives. Once fringe players, offshore operators now offer a tempting proposition: faster onboarding, broader product access, and fewer restrictions.

These sites sit beyond the reach of the regulator and contribute nothing to the domestic tax base. This month we explore what is driving that migration, and what it will take to keep the regulated market competitive.

Consumer protection

Wagering operators have not always met public expectations in safeguarding consumers. High-profile cases, often involving treatment of VIP customers and substantial losses, have, in the past, attracted intense media and political scrutiny. Despite the relative stability of problem gambling rates in the UK, currently at just 0.4% of the population (NHS England), political pressure has demanded better consumer protection measures.

That response took shape in 2019 when the Gambling Commission issued “customer-interaction” guidance which told operators to verify whether each player could sustain their spend. The Gambling Commission supplied examples of good practice but initially no hard thresholds, placing full responsibility on licensees for interpretation.

The funnel effect

The outcome has been what independent bookmaker AK Bets describes as a funnel effect. Most punters start at the big names: Bet365, Paddy Power, Sky Bet. These firms dominate on brand recognition and market share. But with size comes scrutiny: any compliance slips affects thousands of customers and carries significant reputational and financial risk.

To avoid the penalties that have increased in frequency since 2019, linked to both player protection and anti-money laundering failures, these firms err heavily on the side of caution. To assess whether a player can afford their spend, operators ask for bank statements, payslips, and other sensitive documents. The risk-reward calculation is straightforward: it’s simply not worth leaving anything to doubt.

The vast majority of customers refuse to engage. With no shortage of bookmakers in the UK, frustrated customers migrate to other operators seeking a less intrusive experience.

The cascade effect

This creates an unintended cascade effect. Players move from major licensed operators to mid-sized firms, then to smaller operators that may offer a more personal experience. However, as these operators are bound by the same regulatory framework, customers eventually face similar demands for financial documentation. The funnel continues, pushing bettors down the chain until they land with offshore operators that ask very few questions.

As more bettors find options outside the regulated market, they share those experiences with others. Familiarity and confidence build around unlicensed alternatives. The more that go offshore, the more likely others are to follow.

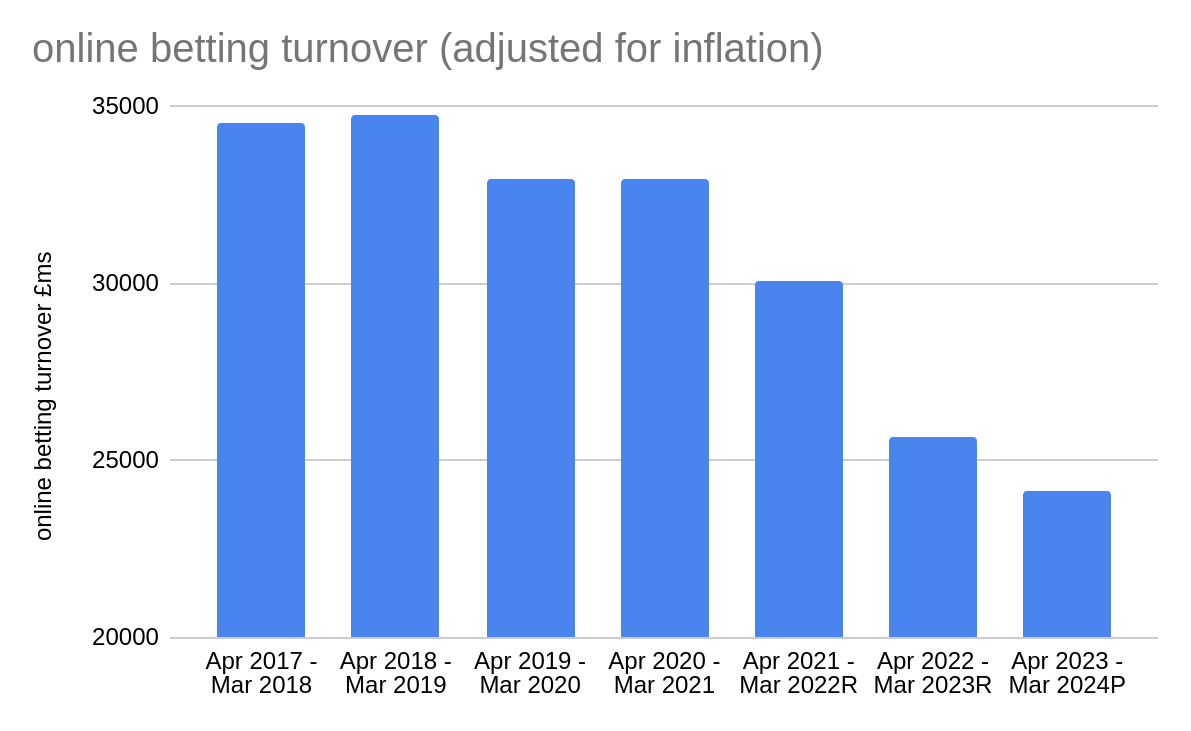

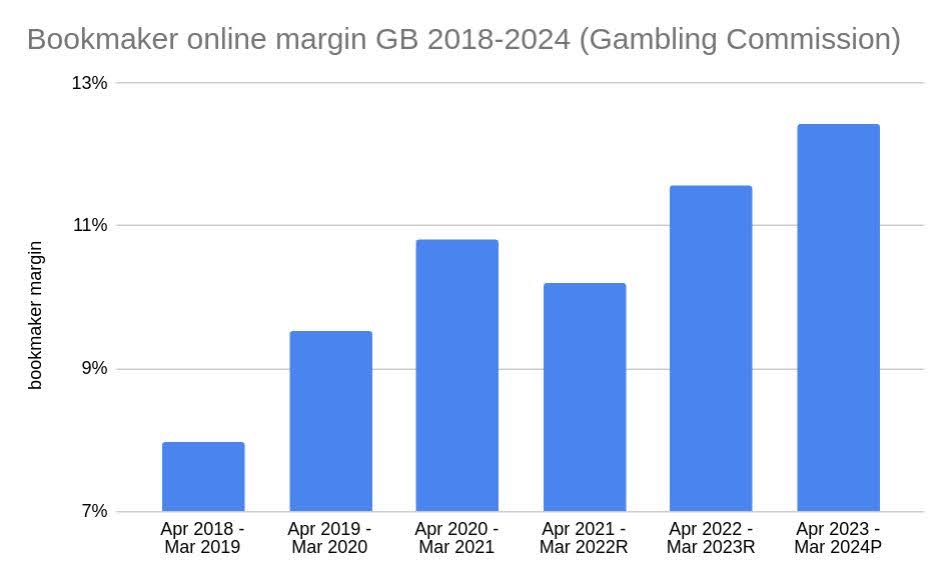

This migration undermines the original policy intent. Legal operators, constrained by compliance costs and facing shorter customer lifespans, become increasingly focused on short-term revenue rather than long-term relationships. Pricing and promotions worsen, service quality declines, and the appeal of the regulated market fades.

The miscalculation

In 2024, the scale of the disconnect became clear. Following a Freedom of Information request by Regulus Partners, the Gambling Commission released the findings of a 2021 survey it had never previously published. The question was simple: would bettors be willing to provide financial documents to operators if asked? Only 14% said yes.

In short, the policy overlooked a critical behavioural barrier: Most consumers are unwilling to share sensitive financial information with betting operators. That reluctance has shaped everything that followed.

Racing betting suffers

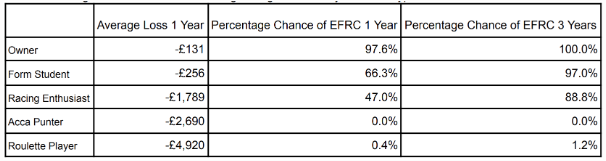

Chris Fawcett’s analysis highlights how racing is disproportionately affected by financial risk checks proposed in the 2023 White Paper. According to his modelling, a racehorse owner placing just two £1,000 bets per year faces a 98% chance of being asked for financial documentation, despite expected annual losses of only £131. In contrast, a roulette player betting £500 daily, with average losses exceeding £4,900 per year, faces just a 2.1% chance of triggering checks even after five years.

This asymmetry has real consequences. The sport is uniquely reliant on betting, particularly from a relatively small group of high-value participants. Unlike football and other major sports, where media rights and sponsorships dominate revenue, racing relies on betting turnover and gross profit to sustain its funding model.

Betting and gaming duties are forecast to raise £3.8 billion for the UK Treasury in 2025–26. Horse racing itself generates £4.1 billion in economic value and supports 85,000 jobs, many in rural communities with limited alternatives. That ecosystem only works if wagering on racing remains appealing to its core audience.

Planned tax reform would add further pressure. The government is considering harmonising gambling tax rates, increasing duty on sports and racing from 15% to 21%, aligning it with online casino products. The British Horseracing Authority estimates this change would cost the sport £66 million annually if introduced, with the earliest implementation date expected in October 2027.

From marginal to mainstream

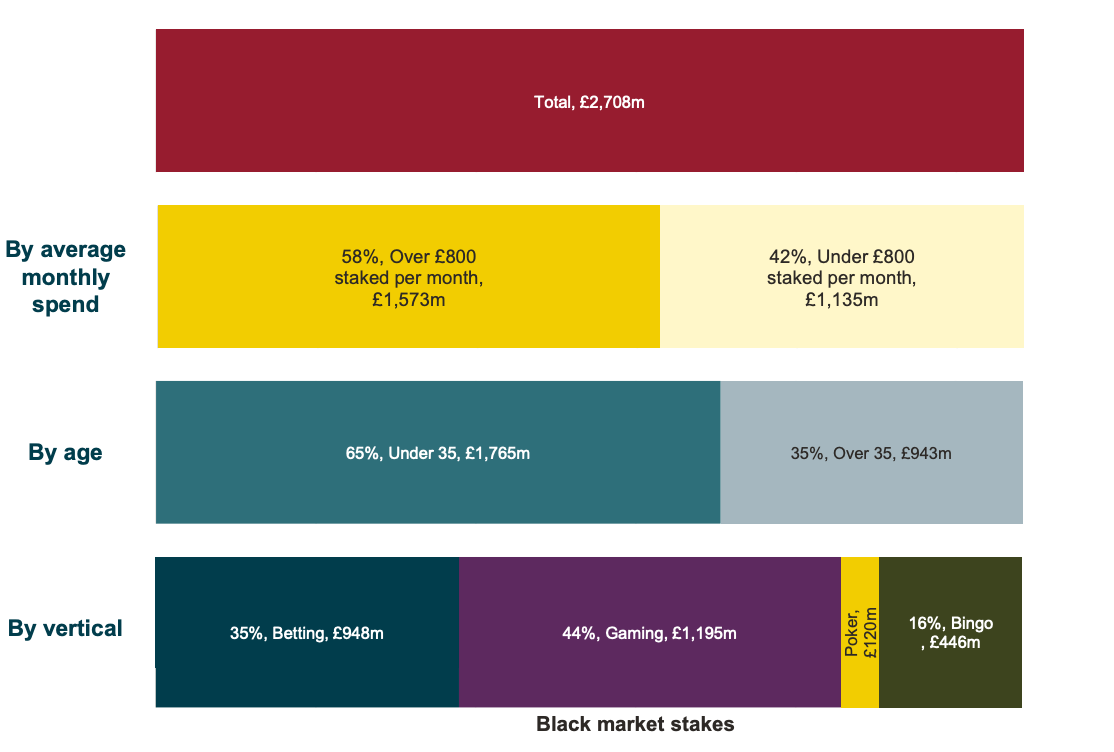

As friction within the regulated market has increased, informal alternatives have filled the gap. Many higher-staking racing bettors have turned to WhatsApp groups offering unlicensed bookmaking. These operations offer no protection and no recourse, but they meet a demand the regulated sector is failing to serve.

More significant is the rapid growth of offshore operators. Free from the costs of compliance and tax, they offer polished platforms, generous limits, and frequent promotions. The claim that these firms will not pay out becomes less convincing at scale. Many are well-funded, internationally active, and have strong incentives to settle bets and retain customers. Taking a large wager is fundamental to customer retention and their reputation.

Australia provides a useful example of how product restrictions can have undesired consequences. With in-play betting and online casinos restricted, significant betting activity has shifted offshore, raising questions about long-term tax capture and consumer protection.

Affordability checks hit high-value players hardest. In Australia, this segment contributes an estimated 30-40% of operator revenue (H2 Gambling Capital). Offshore operators have been quick to fill the gap. In the UK, the number of VIP players is thought to have fallen 95% since 2020 (iGB). For any jurisdiction considering similar measures, the message is clear: if you can’t cater to your most valuable customers, others will.

The Gen-Z shift in betting

A generational change is accelerating this shift. Gen Z users are digital-native, privacy-conscious, and disconnected from traditional entry points. They are more likely to discover betting through Telegram, TikTok, or Discord than through app stores or search engines.

These users are not leaving the regulated market. They are bypassing it entirely. Many place their first bets on offshore or crypto-native platforms. Once there, few see a reason to return to a more restrictive system.

Proposals to ban or limit gambling advertising risk widening this divide. If offshore platforms can continue to grow through content creators and private communities, the regulated market risks becoming invisible, especially to a younger generation.

The opportunity

For most people, gambling is a form of entertainment that offers enjoyment, utility, and social connection. When betting regulation becomes too restrictive through higher taxes, compliance burdens, or product bans, that demand flows to the path of least resistance. The result is not just a loss of tax revenue, but a loss of oversight and consumer protection. While most players still operate within the licensed market, the shift is underway, and the opportunity to course-correct is narrowing.

To remain competitive, the regulated market must offer speed, value, product parity and a user experience that matches modern expectations. That means instant onboarding, full product offering, seamless KYC, real-time payments, personalised markets, and instant transition from content to betting to gaming.

Ultimately, betting regulation must align with how consumers actually behave. The future of the licensed market depends on keeping pace with the people it is meant to serve.

Waterhouse VC is searching for businesses utilising AI tools that can assist governments and regulators to halt the leakage to black market operators.

Waterhouse VC is a fund that specialises in global publicly listed and private businesses related to wagering and gaming sectors. The fund is only available to wholesale investors.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of +3,438% (annualised at 84%), as at 30 June 2025, assuming the reinvestment of all distributions.

More Information & Source

Original Source:

Visit Original Website

Read Full News:

Click Here to Read More

Have questions or feedback?

Contact Us